OUTvest is an authorised FSP. The OUTvest Fixed OUTcome Endowment is underwritten by OUTsurance Life Insurance Company.

When considering investment options, you need to be aware that interest rates are quoted in different ways.

Making sense of this can be confusing and we would like to explain the different ways interest rates are quoted through the use of an example.

Say you have R100 000 and you want to invest it for 5 years (60 months) with your interest paid at maturity.

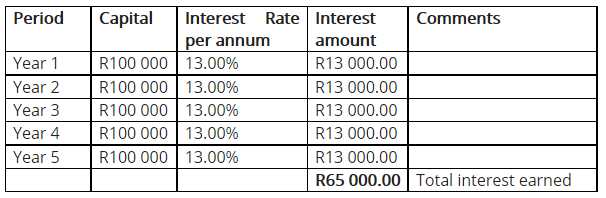

In this example, you find an investment option, where the rate advertised is a 13% simple, non-compounding rate.

This means that you earn 13% interest on the original capital amount invested, every year until maturity.

On maturity date (60 months after you invested your R100 000) you will get back your capital with all the interest, being R165 000 (R100 000 capital + R65 000 interest earned) as calculated in the table below.

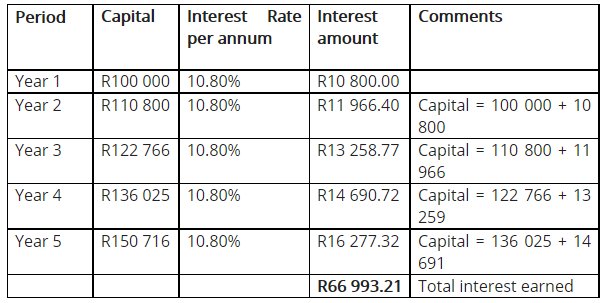

After seeing the 13% simple, non-compounding rate, you notice another investment option where the rate advertised is 10.80% annually compounded.

Just looking at the rates, the 13% looks more attractive than the 10.80% rate. However, a compounding rate means you earn interest on interest.

As you can see from the below calculation, the 10.80% annual compounded rate will actually mean that you get back R166 993 (R100 000 capital + R66 993 interest earned) on maturity date, as oppose to the R165 000 with the 13% simple rate.

A further complicating matter is also the fact that you could potentially be paying tax on the interest earned.

I use the word potentially, because this very much depends on your personal circumstances and tax planning strategies you are applying.

If you are however going to pay tax, this will naturally have an impact on the final amount available to be used by you.

One of the attractive features of the OUTvest Fixed OUTcome Endowment, is the fact that you will not be liable for tax on the amount paid out to you after 5 years.

We have written another article that explain tax in an endowment which you can find here.

To help you to be able to compare our after-tax endowment rate with before-tax rates, we’ve built a calculator. If you have not yet used it, you can find the calculator on our rates calculator page.

In conclusion, when making your investment choices you cannot look purely at the rate quoted on different investment alternatives.

Make sure that compare rates using the same interest rate calculation method.